Financed Projects

Financing energy efficient, renewable, and resilient infrastructure across the nation

Office Building Energy Retrofit

Trophy office building in Philadelphia utilizes $25.5 million of C-PACE to finance efficiency upgrades while maintaining debt yield.

2.53 MW Industrial Solar

A global food processing company meets its sustainability goals by utilizing C-PACE to finance 2.53MW solar PV system in Illinois.

Multi-tenant HVAC retrofit

The Kirkbride Center, a 6 building campus in Philadelphia with a National Historic Landmark status, utilizes C-PACE to install new boiler and chiller plants with automated controls to keep the facility operating efficiently.

8MW Biogas Cogeneration for Industrial

$18 million in C-PACE finances 8 MW cogeneration system capable of meeting 100% of a Michigan industrial property’s electrical load with on-site biogas production.

Affordable Housing New Construction

$14.5 million in C-PACE helps developer of 120 unit Class A multifamily take advantage of LA TOC Incentive Program that encourages affordable housing with high-density construction near bus and train stations.

New Market Tax Credits and C-PACE

$4.6 million C-PACE supports the leverage of NMTC source loan in the conversion of a former factory into a multi-tenant commercial kitchen with 5 lenders advocating C-PACE for energy efficient economic development in Chicago.

Acute Care Hospitals

$49.5 million for a hospital network in California finances more than 70 projects at 5 locations to comply with OSHPD code and to reduce energy and water use through replacement of aging equipment.

C-PACE and Complicated Cap Stack

C- PACE combined with Brownfield/TIF, HTC, Michigan economic development grant and senior mortgage finances the gut renovation of two historic mixed use buildings steps from the Michigan Capital Buiding in Lansing.

Multifamily New Construction

This San Diego area developer augments construction loan with $14.5 million in C-PACE for a Class A multifamily development near a vibrant town center.

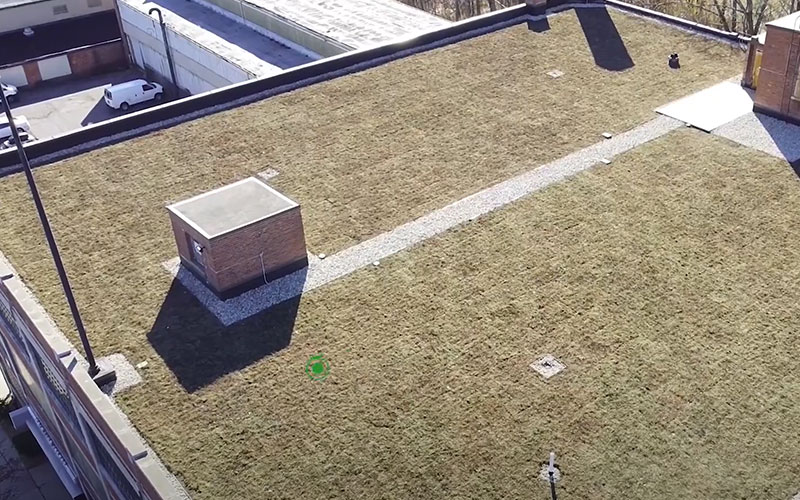

Green Roof on Existing Building

The owner of a former manufacturing building realizes positive annual cash flow by using C-PACE with stormwater incentives in the reroofing of a Detroit NNN flex space property.

Seismic and Soft-Story Retrofit Cases

Selected by the City of San Francisco in 2015 as its PACE financing partner for the mandatory soft-story retrofit program, we have deep expertise financing seismic retrofits and have provided capital to hundreds of property owners to finance seismic, ADUs, and other energy improvements.