C-PACE Outlook For

New Construction In 2023

- Date: 2 January 2023

- Source: Dodge Construction Network

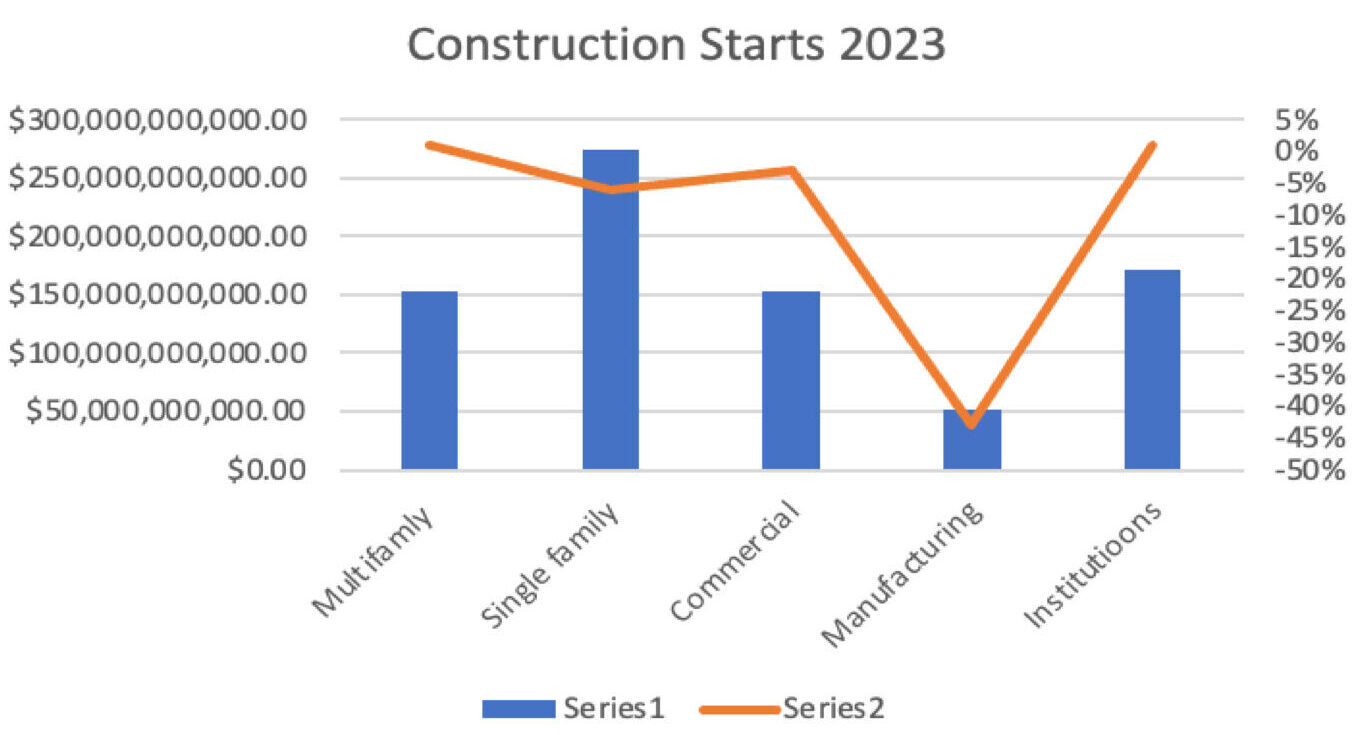

Dodge forecasts $427 billion for 2023 construction starts despite rising interest rates

According to the Dodge Construction Network, commercial starts are predicted to be only 3% lower in 2023 than in 2022. Manufacturing starts are predicted to remain well above historic norms with institutional starts supported by strength in education, government, and healthcare.

With $122.17 million including C-PACE for an Archer Western multifamily development breaking ground January 2023 in TX, CounterpointeSRE sees continued expansive growth in the utilization of C-PACE in 2023. C-PACE’s ability to lower the weighted average cost of capital for developers reducing risk of development and boosting returns will continue to drive the utilization of C-PACE by commercial construction companies.

Given the current short term rate environment for construction loans, C-PACE provides developers with long term financing to lock in a part of their capital stack while reducing the overall cost of the debt to allow projects to move forward.

About C-PACE:

C-PACE financing is a non ad-valorem tax assessment levied on the property for qualified infrastructure and is repaid alongside all other property taxes without impacting the owner’s balance sheet. C-PACE enhances the value of the building while freeing the need to choose between projects with ROI limitations and other capital expenditures. This provides an innovative financing solution that helps owners overcome the barrier of high up-front costs with 100% financing that allows development of the most efficient building infrastructure that will not compete with other investment opportunities.

About Counterpointe Sustainable Real Estate:

Counterpointe Sustainable invests at the intersection of the commercial real estate and energy industries through diversified ESG infrastructure investments including PACE and other financial tools. Since 2013, we have had a major impact in reducing the commercial building sector’s carbon footprint and in providing resiliency to the nation’s infrastructure.